Free SARS Tax Calculator 2022

HMRC will use your Self Assessment to calculate how much Income Tax and National Insurance you need to pay. Do I have to file a Self Assessment? As an on-demand driver, you'll be classed as self-employed from the moment your gross income exceeds the tax-free trading allowance of £1,000 per year.

Uber GST Explained Complete Guide to GST for Uber Drivers

How prices are estimated In most cities, your cost is calculated up front, before you confirm your ride. In others, you will see an estimated price range (see applicable price terms in your city). Here are some fees and factors that can affect your price: Base rate The base rate is determined by the time and distance of a trip. Operating fee

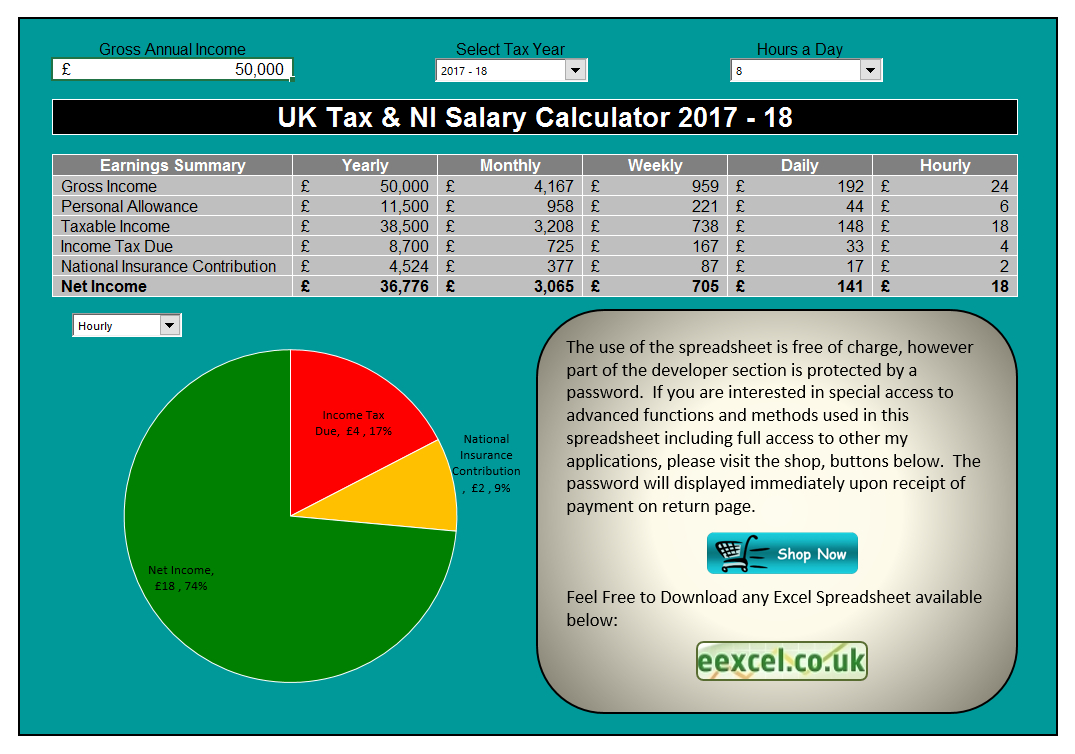

Uk Tax Calculator Excel Spreadsheet 2018 —

We Have Helped More Than 10 Million People To Find Unbiased Advice. Explore Our Treasury Of Tips and Guides For Every Stage Of Life.

Uber Eats Tax Calculator How Much Extra Will I Pay from Uber Eats

1. Check your tax code - you may be owed £1,000s: free tax code calculator 2. Transfer unused allowance to your spouse: marriage tax allowance 3. Reduce tax if you wear/wore a uniform: uniform tax rebate 4. Up to £2,000/yr free per child to help with childcare costs: tax-free childcare 5. Take home over £500/mth?

UBER GST and TAX Calculator ALITAX YouTube

Paul Reed September 8, 2021 Accounting / General 0 Comments As an Uber driver, handling the complexities of tax for self-employment might be challenging. Even if you have accounting knowledge, managing the taxes as a self-employed Uber driver is no small feat that even experienced drivers still experience some problems.

Uber eats taxes calculator KellyannOcean

Are you a ride-sharing/Uber driver? Use our uber tax calculator and find out your net profit and the tax you owe for the 2021/2022 year. Acasa;. 02089250070 07530951855 [email protected]. English;

2018 Uber Driver Earnings and 1099 Tax Calculator Uber driver, Uber, Calculator

1. Register with HMRC If you haven't already, you'll need to register with HMRC as self-employed. This can be done online and ensures that HMRC knows to expect a Self Assessment tax return from you. 2. Maintain Accurate Records Keep a record of: All earnings from Uber Eats.

Uber Taxes Calculator

Self Assessment UK Tax Return Software for Uber and Taxi Drivers The freedom of an Uber or taxi driver has one setback: the tax return. You'll need to figure out the correct calculations and what vehicle-related expenses you can claim, as well as submit the Self Assessment to HMRC.

Uber Tax Explained Ultimate Guide to Tax for Uber & Rideshare

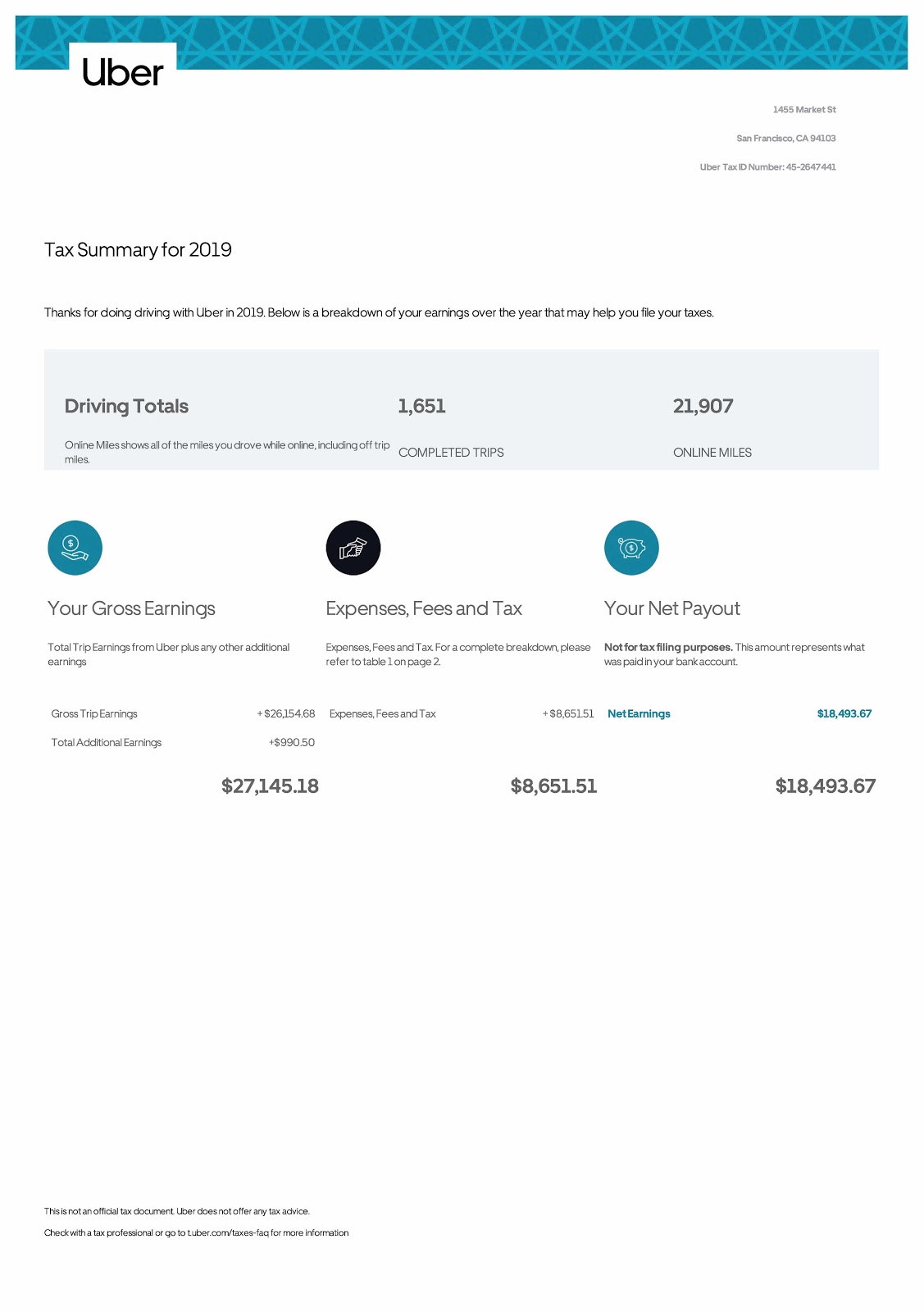

The Uber Tax Summary is designed to help you keep more of what you've earned over the year. The Tax Summary provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible. Potential deductible business-related expenses may vary depending on how your business is set up.

Uber eats taxes calculator KellyannOcean

The VAT you collect from selling your services (transportation services sold to Uber) is payable to HMRC with your VAT return. VAT on business expenses Besides collecting VAT, you may also be charged VAT on your business expenditure. For example fuel and car repairs.

Uber eats taxes calculator KellyannOcean

Do I need to pay tax as an Uber driver? Yes - but the tax-free trading allowance means you can earn up to £1,000 from self-employment in a tax year, before you need to let HMRC know. If your self-employed earnings reach this threshold, you'll normally set yourself up as a sole trader.

CIPE’s Bosnia and Herzegovina Partners Mark “Tax Freedom Day” with a New Tax Calculator Center

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2023 to 5 April 2024). This tells you your take-home pay if you do not.

Uber Tax Calculator Uk CALCULATORSA

Calculate What is an Uber tax calculator? If you work as an Uber driver, you'll have to pay tax on the money you make from driving if you earn over £1,000 in a tax year. The tax year runs from 6th April to 5th April, unlike the financial year which runs from 1st January to 31st December.

Uber eats taxes calculator KellyannOcean

Last updated 21 Sep 2023 What exactly can you claim on your taxes for Uber? As an Uber driver, you should file a Self Assessment tax return on any earnings you make over £1,000. Although there's a lot of debate about whether Uber drivers are employed or self-employed, HMRC still requires all drivers to declare their earnings.

9 Concepts You Must Know to Understand Uber Eats Taxes Guide)

1. How Taxes Work for Self-Employed Uber Drivers 2. What is Self-Assessment? 3. What is a Tax Return? 4. How Much Tax You Pay On Uber Earnings 5. Tax Deductions for Self-Employed Uber Drivers 5.1 Claiming for a Car on Uber Taxes 5.2 Claiming for Car Lease Payments on Your Uber Eats Taxes 6. How to Register as a Self-Employed Uber Driver 1.

uber eats tax calculator canada Thora Heath

Beat Rising Living Costs & Get A £3K Tax Refund Back In Your Bank Account With RIFT. Work-Related Travel That's Not Reimbursed? Potentially Reclaim £3,000 from HMRC